FAQs

// FREQUENTLY ASKED QUESTIONS

Questions and Answers for All Employees

General

What are we announcing?

Enovis is excited to announce a definitive agreement to acquire LimaCorporate S.p.A., a privately held global orthopedic leader focused on restoring motion through digital innovation and customized hardware.

Why are we acquiring LimaCorporate?

LimaCorporate will bring a complementary product portfolio and customer base to Enovis’ Reconstructive (Recon) segment that rapidly reshapes the Company’s surgical sales mix to accelerate growth and expand margins. As a leader in 3D printing, Lima will strengthen Enovis’ innovation pipeline and capabilities while its operations will provide Enovis scale and efficiencies.

How many employees does Lima have?

Approximately 1000 employees with about 70% located in Italy.

What is the timing associated with this acquisition?

The acquisition is targeted for completion in early 2024 and is conditioned on the receipt of applicable regulatory approvals and other customary closing conditions.

What happens between now and the close of the acquisition?

Until this transaction is complete, it’s business as usual for most employees. The most important thing to do now is stay focused on running our business, serving our customers, and executing our current strategy. We have a clear transition plan and look forward to working together to combine our great strengths. This acquisition is targeted for completion by early 2024, subject to the receipt of applicable regulatory approvals and other customary closing conditions.

We will provide frequent updates and will work together to shape the future of Enovis.

How are we paying for this acquisition?

Enovis expects to fund the transaction with cash and the issuance of Enovis shares.

* How will Enovis ensure cultural alignment during the integration phase?

Cultural alignment comes in two forms — country culture and company culture — and our integration plan will consider both. From an overall perspective, we will begin by introducing the Enovis purpose, values, and behaviors and communicate frequently.

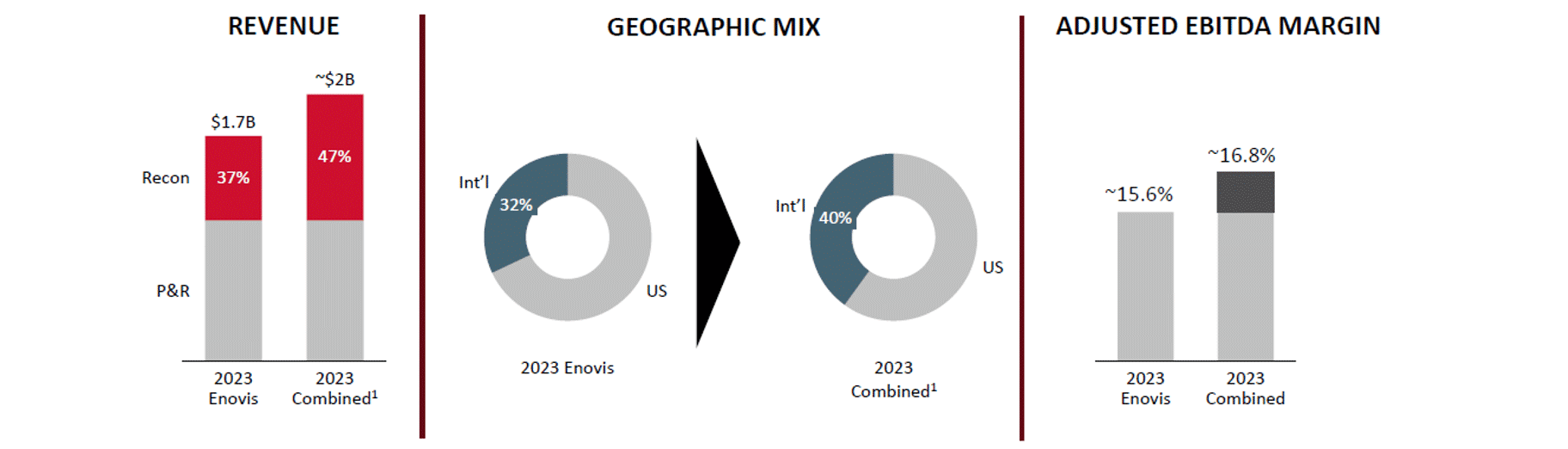

* With our Lima acquisition, how does our revenue, geographic mix and EBITDA margin change?

1: Latest ENOV guidance plus estimated LimaCorporate 2023 full year financials adjusted for IFRS to US GAAP differences; Excludes any expected synergies

* How will the brand architecture of Enovis, Lima and Mathys look? For example, at trade shows.

Branding is a critical integration workstream. We will work with teams from Enovis, including Mathys and Lima, to develop a thoughtful and comprehensive plan for brand migration that addresses our internal and external stakeholders, key communications vehicles, and the best timing for these important changes.

* How does the acquisition affect our cash position moving forward for further M&A activities and internal R&D investment in the next 2-5 years?

M&A continues to be foundational to our growth strategy and we have extensive experience with integration. We will continue to invest in growth and explore opportunities that help us achieve our strategic goals. In fact, the acquisition of Lima creates a strong financial profile for Enovis as a result of cross-selling opportunities, innovation, robust R&D and operations capabilities, and great talent additions.

* What are the distinct strengths of the two companies that you hope to leverage to enable faster growth?

This strategic combination of LimaCorporate and Enovis will create one the world’s leading medical technology companies and a global leader in orthopaedics. Limacorporate brings a complementary product portfolio and customer base to Enovis’ Reconstructive segment that will rapidly reshape the Company’s sales mix to accelerate growth. As leader in 3D printing, LimaCorporate will also strengthen Enovis’ innovation pipeline and capabilities, while its operations will provide Enovis scale and efficiencies. Together, LimaCorporate and Enovis will expand and grow a shared innovation pipeline, strong operational and manufacturing capabilities, a robust R&D platform, and a powerhouse team of employees around the world.

* The Swiss company Mathys is part of the Enovis group and a very strong competitor with higher sales in Switzerland. What will happen to the Lima Switzerland subsidiary?

In most every country there is one team that has higher sales than the other team. The goal is to maintain the revenue from both teams. We will review each country with the country leaders and determine a comprehensive commercial strategy.

Organizational Structure & Locations

Where does this acquisition fit within our organizational structure?

We intend to combine LimaCorporate international and Mathys into a powerful International Surgical business, Enovis International Surgical. LimaCorporate U.S. employees will combine with U.S. Enovis Surgical to further expand this high-growth business.

Why do you plan to combine Mathys and LimaCorporate international?

By combining Lima and Mathys into Enovis International Surgical, a powerful International business, the combined organization will have the best of both legacy organizations, gaining market share and access to the best products across both portfolios. With Lima’s complementary surgical solutions and customers, we will have the opportunity to grow our profitable reconstructive portfolio and further expand our global presence.

Who will lead the new International Surgical business?

Benjamin (Beni) Reinmann will lead the International Surgical business. Andrew Fox-Smith will lead International.

Changes in Leadership – Will there be changes in the leadership or management team of the acquired company? How might this impact our relationship?

As announced, Beni Reinmann from Enovis will lead the combined International Surgical business, but this will not impact your day-to-day contacts within Enovis. There are no immediate changes to the leadership or management teams. As we continue to make progress on the integration and get closer to closing, we will keep you informed of any changes.

Integration – How long will the acquisition take to close and how are we managing it?

M&A is foundational to our growth strategy and we have extensive experience with integration. This integration will be managed through a centralized, multi-disciplinary team and we expect to close the transaction by early 2024 subject to the receipt of applicable regulatory approvals and other customary closing conditions.

Where will the International Surgical HQ be located?

The new International Surgical business will be run out of Bettlach, Switzerland and San Daniele, Italy.

How are you building the new International Surgical organization?

Benjamin Reinmann will lead the International Surgical business. We will identify the best talent from both organizations for our new structure and will share additional details as we get closer to closing.

Will there be any changes to our locations? What will happen to Lima locations?

There will be no immediate changes to any of our locations. As we thoughtfully combine our organizations, our location strategy will be an important part of integration as we focus on optimizing our structure for growth and efficiency.

How will we approach our manufacturing sites?

All four sites, Bettlach, San Daniele, Segesta and Austin will continue manufacturing.

Both San Daniele and Segesta will continue to be manufacturing hubs with Segesta being the Center of Excellence for 3D printing and San Daniele being the Center of Excellence for metals.

Employment Questions

What will happen to LimaCorporate benefits, vacation, health care, pension and pay?

Our objective is to ensure there is no meaningful change to the quality and cost of your current benefits.

For LimaCorporate employee in the U.S., benefits programs and pay cycles in the U.S. will be consolidated into the existing Enovis programs as of January 2024 assuming we are past the close date. Employee data will be managed in Workday, Enovis’ global HR management system

In countries outside the U.S., benefits will be consolidated to one program/ scheme within each country. The effective date of the changes will vary based on current contracts. Employee records, approval processes, hire requisitions, performance and pay management will migrated to Workday.

Do we expect reductions in force as a result of this acquisition

For the majority of employees, we anticipate no change to your responsibilities.

As we build our new International Surgical business, we will review and refine the organizations to ensure we are positioned to deliver on our long-term goals and optimize our teams for growth and efficiency. We will share additional information as we progress and get closer to close.

How will I know if my job is impacted in the overlap?

For the vast majority of employees, there will be minimal change as we look for grow this important piece of the Enovis business. However, we will be reviewing positions that are similar in terms of roles and responsibilities and evaluate these positions. We will review the go-forward organizations in the impacted areas and the announced leaders of those areas will work with HR to select the best go-forward team. We expect to conduct this work with pace and will inform impacted employees in a timely manner.

Will I get credit for my years of service?

Yes, your employment is considered continuous and for vacation/ holiday and benefits your year of service will be counted. Service for Enovis-specific retirement plans starts at your date of employment with Enovis.

If I have a specific question about my role, who should I contact?

Please contact your HR partner.

Will email addresses change?

LimaCorporate and Mathys employees will receive new Enovis.com email addresses as soon as reasonably possible after closing.

* What are the main changes for the employes and when will these be implemented?

For most employees, daily activities won’t change. From a broader perspective, employees will be able to take advantage of additional opportunities to grow and develop their careers around the world as part of a larger company. In the U.S., the Lima employees will be included in the current US benefit programs. Outside the U.S., over time, we will work to consolidate the benefit packages that are available by country.

* Is Lima fully integrated in Enovis like DJO or are we “another group” like Mathys? Will our name be “Lima” or “Enovis” in the future?

In the near future, Lima and Mathys will both become Enovis allowing all of us to gain the benefits of a powerful master brand. A combined team from Enovis, Mathys and Lima will work with thoughtful speed on the migration to Enovis.

Product Questions

Products – Which products are included with the Lima acquisition?

All Lima products are included in the acquisition. Key examples include:

- Extremities: SMR System, Discovery, TEMA Elbow,

- Knee: Physica system, Physica ZUK, AMF TT Cones

- Hip: DELTA Cup Family, Multiple Femoral, Stem Solutions

- ProMade: Custom made implants through 3D printing

Taking care of our customers and our new customers continues to be our top priority. After closing, over time, market demand will ultimately determine our combined product strategy. At this time, there are no immediate plans to discontinue any Lima or Enovis products. Keep the focus on winning.

I would like to know if any of our portfolio of products will be sold off as part of the sale? Specifically, Enovis will have three shoulder platforms- Lima, Mathys and DJO. Will one be sold off?

At this time, there are no immediate plans to discontinue any LimaCorporate, Mathys or Enovis products. This is a strategic combination predicated on expanding our product lines and geographic reach.

Next Steps

What should I tell people outside of our company about the acquisition of LimaCorporate?

Until completion of the acquisition, it is business as usual. For those in sales, please see your sales leader for specific talking points. For those outside of sales, you are encouraged to let people know that you are excited to embark on this med tech growth journey that will drive further innovation, strengthen our operational and manufacturing capabilities, enhance our R&D platform, and expand our global presence.

What’s our path forward?

Our path forward continues to be focused on building a high-value medical technology growth company focused on improving patient outcomes, driving growth through innovation, leveraging our Enovis Growth Excellence (EGX) business system for continuous improvement, incorporating the best M&A opportunities, and developing talent.

We have a clear transition plan and look forward to working together to combine our great strengths. This acquisition is targeted for completion by early 2024, subject to the receipt of applicable regulatory approvals and other customary closing conditions.

We will provide frequent updates and will work together to shape the future of Enovis.

What should I do if I receive a call from the media asking about this news?

Please do not talk to the media. Please direct these inquiries to Katie Sweet in Corporate Communications or Kyle Rose in Investor Relations

Supply Chain

* What will integration look like in terms of Supply Chain impact?

In the near term, there will be no change as to how the Mathys and LimaCorporate supply chains operate. After closing, and over time, the intent is to optimize and leverage the best of both supply chains to create efficiencies across Enovis.

* How will this news impact active supply chain projects?

For now, all active projects should continue. As we integrate, we will review the projects that are currently in motion at both organizations and make thoughtful decisions about which projects continue, which projects are integrated, and/or which projects are discontinued.

* What can we expect in terms of alignment on ERP systems (SAP/JDE etc), internal processes etc?

We are thoroughly reviewing the IT landscape, and associated processes, as part of our integration planning and will determine how and when to align systems in the coming months.

Do you have a question that hasn’t been answered yet?

Please send your question to EnovisCorporateCommunications@enovis.com and we will answer as many as we can — either on this site or respond directly to you. Thank you!

© Enovis Corporation 2024